Chime (CHYM -6.25%) made its public market debut on June 12, 2025. While the digital bank priced its shares at $27 a piece, investors bid them up well above its initial public offering (IPO) price. The stock opened at $43 on its first day of trading (60% above its IPO price) before closing the day at around $37 (37% above its IPO price). That valued the financial technology company at $13.5 billion.

Chime has taken a new approach to providing financial services to customers. Its mission is to provide financial peace of mind.

Unlike many financial institutions, Chime doesn't make money by charging fees, which allows customers to save more of their money and grow their savings. Instead, Chime makes money when its customers use its branded debit or credit cards. Chime earns a portion of the interchange fee that Visa (V -5.01%) charges merchants.

Chime's fee-free approach to checking and savings accounts is winning over customers who are also signing up for Chime's branded cards. That increases its revenue as customers use its cards to make purchases.

While Chime is growing rapidly, it has a long growth runway ahead as more customers open accounts and it cross-sells additional financial products and services to its customers. Chime's growth potential has made it one of the hottest IPOs of 2025. Here's a guide to everything you need to know about how to invest in Chime now that it's finally public.

IPO

Is it publicly traded?

Is Chime publicly traded?

Chime completed its initial public offering on June 12, 2025, pricing its shares at $27. It now trades on the Nasdaq Stock Market under the ticker CHYM.

How to invest

How to buy Chime stock

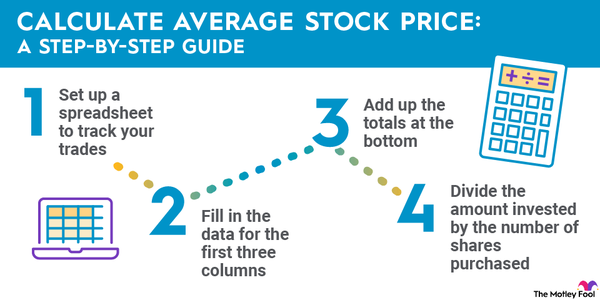

Now that Chime is public, you can buy shares in your brokerage account. Here's a step-by-step guide on how to buy Chime stock:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest?

Should I invest in Chime?

Now that Chime is public, investors interested in the company need to decide whether they should invest in the stock. Here are some factors to consider that might lead you to believe it's a good stock to add to your portfolio:

- You're a fan of Chime and its products.

- You understand how Chime makes money and how it differs from a traditional bank.

- You want to invest in a company that's disrupting the financial sector.

- You believe that Chime will grow its revenue and profits at a high rate.

- You understand the risks of investing in IPO stocks, including the possibility that shares could lose value.

- You're seeking a company with high growth potential.

- Adding a financial technology company like Chime would further diversify your portfolio.

On the other hand, here are some reasons why you might decide not to invest in Chime's IPO:

- You don't use Chime and favor a competitor's products.

- You don't understand Chime's business model.

- You think Chime faces lots of competition, which could slow its growth.

- You're seeking to invest in companies that are less volatile than recent IPOs.

- You already own several financial technology stocks.

- You're not sure the company's share price can continue rising after its red-hot IPO.

- You think Chime's post-IPO valuation is too high.

Chime competitors

Investors interested in Chime should also consider some of its competitors in the financial technology space. Here are three other top fintech stocks:

Nu Holdings

Nu Holdings (NU -0.62%) is a digital financial service company based in Brazil. Like Chime, it provides spending solutions like credit and debit cards. In addition, Nu offers savings, investing, borrowing, and insurance products. The company has more than 118 million customers in Brazil, Mexico, and Colombia as of mid-2025.

PayPal Holdings

PayPal Holdings (PYPL -5.42%) is a digital payments company. Its technology helps people make digital payments to merchants and other PayPal users. PayPal has a massive global user base (more than 434 million at the end of 2024). PayPal is highly profitable and generates significant free cash flow. It returns most of that money to investors by repurchasing shares.

SoFi Technologies

SoFi Technologies (SOFI -5.5%) provides customers with several financial products and services, including bank accounts, credit cards, brokerage accounts, mortgages, student loans, and insurance. The company is expanding quickly as more consumers sign up for its growing list of financial products and services. SoFi has grown its membership at a 52% compound annual rate since 2021, reaching over 10.9 million in early 2025. It also finally achieved profitability in the first quarter of 2025.

Profitability

Is Chime profitable?

Now that Chime is public, it must report its financial results. Those numbers showed that the company was profitable when it went public in mid-2025.

Before becoming public, Chime had posted rising revenue and narrowing losses. In 2023, it produced $1.3 billion in revenue while losing $203 million. Those numbers improved to $1.7 billion in revenue in 2024 and a net loss of $25 million.

Chime has turned the corner on profitability. It reported $519 million of revenue in the first quarter of 2025 and $13 million of net income.

However, Chime has warned that it might not remain profitable as it continues to spend on growth. Because of that, investors need to keep a close eye on its profitability in the future. Profit growth is a key driver of stock price gains over the long term.

Dividend

Does Chime pay a dividend?

Chime didn't pay dividends as of mid-2025. The company had just completed its IPO and was retaining its earnings to fund its growth.

ETFs

ETFs with exposure to Chime

While Chime is now public, you can't yet gain passive exposure to the fintech company through an exchange-traded fund (ETF). It typically takes several months before an IPO stock makes its way into ETFs.

Exchange-Traded Fund (ETF)

However, investors can get some exposure to similar companies in the fintech space through an ETF. Notable ones include the Ark Fintech Innovation ETF (ARKF -0.27%) and the Global X FinTech ETF (FINX -2.62%). The Ark Fintech Innovation ETF is an actively managed fund by the well-known Cathie Wood. Meanwhile, the Global X FinTech ETF aims to track the Indxx Global FinTech Thematic Index. Either fund would provide investors with exposure to the fast-growing fintech space.

Another option to consider is the Renaissance IPO ETF (IPO -1.99%). The fund is typically one of the first to add a newly public company.

Related investing topics

Stock splits

Will Chime stock split?

Chime didn't have an upcoming stock split as of mid-2025. The company had only recently completed its IPO.

However, shares soared in their debut, jumping more than 60% at one point. If Chime stock continues to rise, it might need to split its stock before long.

The bottom line on Chime

Chime's fee-free approach to providing basic banking services to customers is winning them over. The company is growing quickly, which could continue. That growth potential has made Chime one of the most widely anticipated IPOs.

FAQ

Investing in Chime FAQ

Can I invest in Chime?

Yes, you can invest in Chime. The company went public on the Nasdaq Stock Market on June 12, 2025. It trades under the stock ticker CHYM.

How do you invest in Chime?

You can buy shares of Chime in any brokerage account. Here's how to buy its stock:

1. Open your brokerage app.

2. Search for the stock.

3. Decide how many shares to buy.

4. Select order type.

5. Submit your order.

6. Review your purchase.

Will Chime go public?

Yes, Chime completed its initial public offering on June 12, 2025. The company now trades on the Nasdaq Stock Market under the ticker CHYM.

Is Chime profitable?

Yes, Chime was a profitable company as of the first quarter of 2025. The digital bank reported $519 million of revenue and $13 million of net income during that period.